FHA MORTGAGE LENDERS CORPUS CHRISTI TEXAS

Popular Corpus Christi Texas Mortgage Programs Include:

- FHA Corpus Christi Texas Mortgage Lenders

- Bank Statment Only Corpus Christi Texas Mortgage Lenders

- VA Corpus Christi Texas Mortgage Lenders

- Self Employed Corpus Christi Texas Mortgage Lenders

- Bad Credit Corpus Christi Texas Mortgage Lenders

- Corpus Christi Texas FHA Mortgage Lenders

- Arlinton Texas FHA Mortgage guidelines

- NO Credit Score Corpus Christi Texas Mortgage Lenders

- Bad Credit Corpus Christi Texas FHA Mortgage Lenders

- Corpus Christi Texas Stated Income Mortgage Lenders

- Corpus Christi Texas Mortgage After Foreclosure Or Bankruptcy!

- Texas Mortgage Lenders with Collection accounts OK!

FHA MORTGAGE REFINANCE CORPUS CHRISTI TEXAS

FHA MORTGAGE REFINANCE

FHA mortgage refinancing your current adjustable rate mortgage with FHA mortgage refinancing is a great option way to secure a 15 or 30 year fixed rate term. FHA mortgage lenders allow for easier credit qualifying and more flexibility than conventional loans. Current homeowners can also FHA cash out equity in their current home to pay off high interest debt, make home improvements or pay any other expenses.

FHA CASH-OUT REFINANCE ADVANTAGES INCLUDE:

- FHA Cash Out Refinance up to 85% for existing or new FHA mortgages.

- FHA Cash Out up to 85% of your properties value.

- Consolidate any type of first and second mortgages into single FHA loan.

- FHA Mortgage Refinance For Bill consolidation.

- Easier credit and income qualifications.

- FHA regulated closing costs make it the most affordable.

96.5% RATE OR TERM FHA MORTGAGE REFINANCE:

- Low Fico Score OK

- Easier credit and income qualifications.

- FHA Refinance to Consolidate first and second mortgages one FHA mortgage.

- FHA Refinance Land contact.

- FHA Refinance a Rent TO Own Purchase.

- Easier credit and income qualifications.

- FHA regulated closing costs.

FHA STREAMLINE MORTGAGE REFINANCE:

- FHA refinance your current FHA mortgage with NO Appraisal!

- No Cost Interest Rate Reductions programs.

- No Income or Credit Qualifications.

- Easily switch from Adjustable mortgage to FHA Fixed Mortgage

- Easily shorten or lengthen term of your existing loan.

FHA CASH-OUT MORTGAGE REFINANCE: If you have built up equity in your home and your financial situation may benefit by access to extra cash, you may want to consider an FHA Cash Out Mortgage Refinance.FHA Cash Out Mortgage Refinancing may be right for you if you would like to:

- Reduce the amount of high-interest debt you have, including credit cards or student loans

- Pay off Higher Interest Debt

- Obtain cash for medical bills or other expenses

- Plan a Special vacation or spend the funds as you wish.

FHA REFINANCE TO HELP HOMEOWNERS

FHA just announced the monthly FHA mortgage insurance costs (PMI) is going to be reduced for 2015. This is not only great news for new home buyers purchasing with FHA financing but also wonderful news for existing FHA mortgage holders that pay higher mortgage insurance costs each month. If you received an FHA mortgage over the last 5 years, you are likely paying the higher FHA MIP rate of 1.15% – 1.35%. Please contact us below to see if an FHA refinance with the new lower .85% MIP makes sense for you. In addition to the FHA MIP reductions, interest rates are near all-time lows. This means qualified homeowners may be able to lower their interest rate at the same thus increasing their monthly savings even more.

FHA REFINANCE SUMMARY OF OPTIONS:

- Streamline FHA Mortgage Refinance: The FHA Streamline Refinance is designed to lower the interest rate on a current FHA mortgage OR convert a current FHA adjustable rate mortgage into a fixed rate. A Streamline FHA Refinance Loan can be performed quickly and easily. It typically requires less paperwork than a normal refinance and often no appraisal, qualifying debt ratios or income verification. Current home loan to value or “LTV” is not important. So if you are underwater on your home value, this is the program for you.

- FHA Mortgage Refinance Rate/Term: The FHA rate and term refinance is for U.S. home owners who currently have a conventional fixed rate or ARM mortgage and wish to FHA mortgage refinance into a lower interest rate. Remember, you do NOT have to currently have a FHA mortgage to FHA refinance into one. The FHA rate/term mortgage refinance helps borrowers who wish to have a secure FHA-insured fixed rate mortgage.

- Cash-Out FHA Mortgage Refinance: A Cash Out FHA mortgage refinance is perfect for the homeowner who would like to access the equity accumulated in their home. The FHA mortgage loan is perfect for homeowners whose property has increased in value since it was purchased. With an FHA cash out mortgage refinance, you can access up to 85% of your home’s value (Loan to Value) and use the money to pay off higher interest debt like credit cards, car payments.

FHA MORTGAGE LENDERS CORPUS CHRISTI TEXAS

Good Credit –Bad Credit – No Credit + No Problem + We work with everyone towards home ownership! Whether you’re a Corpus Christi, Texas first Time buyer moving to a new home, or want to FHA refinance your existing conventional or Corpus Christi, Texas debt Consolidation, or if you cannot meet the FHA mortgage qualifications for an FHA mortgage we will show you how to purchase or refinance a home using our bank statement only mortgage program.

Corpus Christi TEXAS FHA MORTGAGE LENDERS PROVIDE THE BEST OPTIONS: Research Corpus Christi, Texas home loan programs which help you to buy a Corpus Christi, Texas home. Also, learn about FHA minimum credit score requirements, or get pre-approved today. FHA-MORTGAGE-LENDERS.COM will show you the advantages of how to qualify for a Corpus Christi, Texas FHA mortgage if you are a First Time Homebuyer seeking a Bad Credit FHA Mortgage have lack to credit seeking a No Credit FHA Mortgage or a current homeowner and want to learn about an FHA Mortgage Refinance.

Corpus Christi TEXAS FHA MORTGAGE HOME BUYER ADVANTAGES

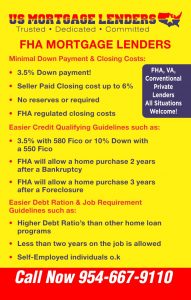

Corpus Christi TEXAS FHA MORTGAGE LENDERS APPROVALS WITH MINIMAL DOWN PAYMENT AND CLOSING FEES:

- Down payment only 3.5% of the purchase price. Gifts from family including gifts of equity or FHA Grants are OK!

- Sellers can credit the buyer’s up to 6% of sales price towards buyers costs and pre-paid.

- No reserves or future payments in account required.

- FHA regulated closing costs.

- Read more about buying a home with an FHA mortgage Bad Credit –No Credit – Investment –Second Home –Multi Family –

Corpus Christi TEXAS FHA MORTGAGE LENDERS MAKE QUALIFYING EASIER BECAUSE YOU CAN PURCHASE:

- 12 months after a chapter 13 Bankruptcy FHA mortgage Lender approvals!

- 24 months after a chapter 7 Bankruptcy FHA mortgage Lender approvals!

- 3 years after a Foreclosure FHA mortgage Lender approvals!

- No Credit Score FHA mortgage Lender approvals!

- 580 required for 96.5% financing or 3.5% down payment FHA mortgage Lender approvals.

- 500 required for 90% financing or 10% down payment FHA mortgage Lender approvals.

- Bad Credit with minimum 500 FICO credit score with 10% Down Payment FHA. For FHA mortgage applicants with credit scores between 500 and 579 must make down payments of at least 10% down!

- Read more about FHA Qualifying Qualification Summary – Manual Underwrite – Collections-Judgement’s – Bankruptcy or Foreclosure – Compensating Factors –

Corpus Christi, Texas FHA MORTGAGE LENDERS ALLOW HIGHER DEBT TO INCOME & EASIER JOB QUALIFYING

- FHA allows higher debt ratio’s than any conventional mortgage loan programs.

- Less than two years on the same job is OK!

- Self-employed buyers can also qualify with FHA Mortgage Lenders.

- Read More about Gifts For Down Payment – Documents Checklist – Debt To Income – Student Loans –

FHA MORTGAGE LENDERS FOR ALL Corpus Christi, Texas PROPERTY TYPES INCLUDING

- Single-family Corpus Christi Texas Homes

- Town homes– To Be Sure its not a condo make sure it has a lot and block check for lot and/or block legal descriptions.

- Manufactured– Manufacture home with land only- No leased land.

- Condominium– Search Corpus Christi, Texas FHA Approved Condos

- Jumbo

- Modular

- Villa– check for lot and/or block legal descriptions.

YOU REALLY NEED AN Corpus Christi, Texas FHA MORTGAGE SPECIALIST! When you decide to apply for a Corpus Christi, Texas home loan through Corpus Christi, Texas FHA mortgage lender you need to know you’re dealing with experienced full-time FHA mortgage lenders who know the ins and out of this complex mortgage program. In additions to the FHA mortgage, we offer a huge assortment of VA lenders including FHA, Conventional & Private Corpus Christi, Texas FHA mortgage programs built around Corpus Christi, Texas home buyers and homeowners.

Whether you’re buying a first home using our great FHA mortgage program or refinancing a home you already own using traditional Corpus Christi, Texas mortgage financing, nothing helps more than having a seasoned Corpus Christi, Texas FHA mortgage lender working hard answer all your Corpus Christi, Texas FHA mortgage questions!

FHA MORTGAGE APPLICANTS INITIAL BUYERS QUESTIONS

- What is an FHA Mortgage loan? The FHA program was created in 1934 and is a division of the Department of (HUD) Housing and Urban Development. An FHA mortgage loan is a mortgage that is insured by the Federal Housing Administration (FHA) and funded by private Corpus Christi, Texas FHA approved mortgage lenders.

- Are FHA mortgage for first time home buyers only? NO, FHA mortgage loans are NOT for first–time buyers only. FHA loans can be used by first time buyers and repeat buyers alike. The FHA mortgage is often marketed as a product for “first–time buyers” because of its low down payment and flexible credit scoreand debt to income ratio requirements. FHA mortgage applicants can even use the program to purchase an FHA approved investment property.

- How Does The FHA Mortgage Insurance Work? Anyone who takes out FHA mortgage finances the insurance into the FHA mortgage loan amount. This “Up Front Mortgage Insurance ” cost is called the “UFMIP”. The upfront mortgage insurance premium paid on all FHA mortgages is paid to the government and use the funding fee money to reimburse Corpus Christi, Texas FHA Mortgage lenders who were forced to foreclose on mortgages that were financed to bad credit mortgage applicants. Think of the funding fee as the foreclosure “insurance fund” for the FHA Corpus Christi, Texas Mortgage Lenders. In addition to the upfront funding fee, the borrower is also required to pay a small monthly fee to the FHA as part of their monthly mortgage payment. The monthly fee is called monthly MIP or mortgage insurance premium.

- Do I have to be a first-time mortgage buyer to use the FHA mortgage? No you do not have to be a first time Corpus Christi, Texas home buyer but the FHA mortgage is only for a Primary home purchase only.

- Can I roll all the closing costs into the FHA mortgage? You are permitted to finance the upfront FHA funding fee only. FHA mortgage closing costs can be paid by the seller up to 6% and must be negotiated up front in your purchase and sale agreement.

- Can I get an FHA Mortgage after a Foreclosure or Bankruptcy? YES! you can qualify for an FHA mortgage 3 years after the title was transferred out of your name.A borrower may also still qualify for an FHA insured loan after declaring Chapter 13 bankruptcy, if at least 1 year of the bankruptcy payout period has passed and the borrower has been making satisfactory payments. In these cases, the FHA mortgage applicant must also request permission from the court to enter into a new FHA mortgage loan. declaring Chapter 7 bankruptcy, if at least 2 years have passed since the bankruptcy discharge date. FHA mortgage applicants must also have re-established good credit or have opted to incur no new debts (this means you specifically chose to take out no new loans, credit cards, etc.)

- What is the minimum down payment for FHA Mortgage? Currently, 3.5% can from family gift or grant.

- Can my parents or other relatives give me money? Yes, provided the money is considered a gift and your relative sign and date the proper gift letter documentation.

- Is there a maximum FHA Mortgage Loan Amount? Yes, see maximum loan limits below based on the Corpus Christi, Texas county.

The FHA mortgage is so popular is because Corpus Christi, Texas mortgage applicants use them are able to take advantage of benefits and protections unavailable with any other mortgage loan program. Loans through the FHA are insured by the government, so the Corpus Christi, Texas mortgage lenders that approve these loans are more lenient. The advantages are outweigh any other mortgage program and include and include the following:

- Lower Cost & Fees- In addition to lower interest rates, FHA borrowers enjoy lower costs on other fees like closing costs, FHA mortgage insurance and govt regulated closing cost.

- Easier to Qualify- While most mortgage loans prohibit applicants with bad credit history and low credit scores, the FHA mortgage loans available with lower requirements so its easier for you to qualify.

- Lowest Interest Rates- You’ve heard the horror stories of subprime borrowers who couldn’t keep up with their mortgage interest rates. Well, FHA loans usually offer lower interest rates to help homeowners afford housing payments.

- Bankruptcy / Foreclosure- You can purchase a home while in a chapter 13 bankruptcy or suffered a previous foreclosure in the past few years doesn’t mean you’re excluded from qualifying for an FHA loan. As long as you meet other requirements that satisfy the FHA, such as re-establishment of good credit, solid payment history, etc., you can still qualify.

- No Credit Score/ No Trade Lines OK! – The FHA usually requires two lines of credit for qualifying applicants. If you don’t have a sufficient credit history, you can try to qualify through a with the FHA no credit mortgage loan!

For many Corpus Christi, Texas FHA mortgage applicants, using an FHA mortgage can really make the difference between owning your dream house affordability and getting out of the never-ending rental trap. The FHA mortgage provides a wealth of benefits for Corpus Christi, Texas mortgage applicants that qualify, so please make full use of them.

| Appraiser Roster as of 03/01/2018 (38 records were selected, 38 records displayed.) |

(38 records were selected, 38 records displayed.)

| Name | License/ Expiration Date |

Address |

| CARL B HELLUMS | TX1320362 (Certified General) 03-31-2019 |

TASADOR, INC. P.O. BOX 81492 CORPUS CHRISTI, TX 784680000 |

| BRUCE A CALLAWAY | TX1320678 (Certified General) 05-31-2019 |

CALLAWAY COMPANY/OWNER 4502 SOUTH STAPLES ST CORPUS CHRISTI, TX 784110000 |

| RACHEL A ZAMORA | TX1321236 (Certified Residential) 06-30-2019 |

INDEPENDENT APPRAISAL SERVICE 6000 S. STAPLES ST, #303 CORPUS CHRISTI, TX 784130000 |

| RANDALL H PIERCE | TX1321249 (Certified Residential) 06-30-2019 |

TASADOR, INC. P O BOX 81492 CORPUS CHRISTI, TX 784680000 |

| RAMONA SINGLETERRY | TX1321285 (Certified Residential) 06-30-2019 |

14493 S.P.I. D., A335 CORPUS CHRISTI, TX 784180000 |

| THOMAS F DORSEY | TX1321311 (Certified General) 06-30-2019 |

THOMAS F. DORSEY & ASSOCIATES 3526 S. ALAMEDA CORPUS CHRISTIE, TX 784110000 |

| DENISE W BENYS | TX1321509 (Certified Residential) 06-30-2019 |

DENISE BENYS, INC. P.O. BOX 260098 CORPUS CHRISTI, TX 784260000 |

| ELMA G SALAZAR | TX1321512 (Certified Residential) 06-30-2019 |

SALAZAR APPRAISAL SERVICE 1333 ORMOND DR, CORPUS CHRISTI, TX 784150000 |

| TERRENCE F WOOD | TX1321592 (Certified General) 02-28-2018 In 30-Day Grace Period Valid until 03-30-2018 |

TERRENCE F. WOOD AND COMPANY 400 MANN STREET SUITE # 509 CORPUS CHRISTI, TX 784010000 |

| SIDNEY H SMITH III | TX1321944 (Certified General) 02-29-2020 |

AMERICAN APPRAISERS, INC. 3230 REID DRIVE SUITE A CORPUS CHRISTI, TX 784040000 |

| WILLIAM B BATEY | TX1322145 (Certified Residential) 02-28-2018 In 30-Day Grace Period Valid until 03-30-2018 |

APICES APPRAISAL GROUP, LLC PO BOX 60134 CORPUS CHRISTI, TX 784660000 |

| JOHN R SOWASH III | TX1322154 (Certified Residential) 02-28-2018 In 30-Day Grace Period Valid until 03-30-2018 |

TASADOR, INC. P.O. BOX 81492 CORPUS CHRISTI, TX 784680000 |

| ALPHONSO GARCIA | TX1324050 (Certified Residential) 11-30-2018 |

P.O. BOX 6112 CORPUS CHRISTI, TX 784110000 |

| RUDOLPHO J GARCIA | TX1324057 (Certified Residential) 11-30-2018 |

RUDY GARCIA PO BOX 270566 CORPUS CHRISTI, TX 784270000 |

| GREGORY L ATCHLEY | TX1324130 (Certified General) 05-31-2019 |

TASADOR, INC. P.O. BOX 81492 CORPUS CHRISTI, TX 784680000 |

| SPENCER R BALENTINE | TX1324397 (Certified Residential) 12-31-2018 |

SPENCER (RAY) BALENTINE 4801 BALDWIN #103 CORPUS CHRISTI, TX 784080000 |

| DANNY J HEDRICK | TX1324831 (Certified Residential) 02-28-2019 |

APICES APPRAISAL GROUP, LLC 3230 REID DRIVE CORPUS CHRISTI, TX 784040000 |

| KAREN M MENN | TX1325338 (Certified Residential) 07-31-2019 |

KAREN MENN, INC. 5134 GRAFORD PLACE CORPUS CHRISTI, TX 784130000 |

| DEBORAH G NICHOLSON | TX1326028 (Certified Residential) 03-31-2018 |

NICHOLSON APPRAISALS PLLC 502 SANTA MONICA PLACE CORPUS CHRISTI, TX 784110000 |

| CHRISTOPHER L NICHOLSON | TX1326211 (Certified General) 05-31-2018 |

NICHOLSON APPRAISALS, PLLC 502 SANTA MONICA PL CORPUS CHRISTI, TX 784110000 |

| PAMELA K TEEL | TX1326749 (Certified General) 07-31-2019 |

5525 S. STAPLES #A-5 CORPUS CHRISTI, TX 784110000 |

| SELINA R TRANBARGER | TX1328567 (Certified Residential) 03-31-2019 |

BAY AREA APPRAISAL SERVICE P. O. BOX 8271 CORPUS CHRISTI, TX 784680000 |

| SYLVIA E SAMUELS | TX1329489 (Certified Residential) 06-30-2018 |

CALLAWAY & COMPANY 4502 SOUTH STAPLES ST. CORPUS CHRISTI, TX 784110000 |

| ALAN W CLOWER | TX1330164 (Certified Residential) 05-31-2019 |

DORSEY & CLOWER APPRAISAL FIRM 3526 SOUTH ALAMEDA CORPUS CHRISTI, TX 784110000 |

| JOSE A ZAMORA | TX1330231 (Certified Residential) 06-30-2019 |

INDEPENDENT APPRAISAL SERVICE P.O. BOX 271387 CORPUS CHRISTI, TX 784270000 |

| RICHARD W WHITT JR | TX1331399 (Certified Residential) 09-30-2018 |

CERTIFIED APPRAISAL SVC, PLLC 320 POENISCH DRIVE CORPUS CHRISTI, TX 784120000 |

| PAUL A COOPER | TX1332311 (Certified Residential) 06-30-2019 |

COOPER APPRAISALS, INC. 13934 MINGO CAY CT APT C CORPUS CHRISTI, TX 784180000 |

| JAMES M HALL | TX1332666 (Certified Residential) 08-31-2019 |

TASADOR INC P.O. BOX 81492 CORPUS CHRISTI, TX 784680000 |

| TERRY A CANFIELD | TX1333148 (Certified Residential) 12-31-2019 |

CANFIELD APPRAISAL SERVICES 3141 QUAIL SPRINGS #7 CORPUS CHRISTI, TX 784140000 |

| ROBERT A KEENEY | TX1333591 (Certified Residential) 04-30-2018 |

A PLUS APPRAISALS & R/E SERVIC P.O.BOX 2832 CORPUS CHRISTI, TX 784030000 |

| CHRISTOPHER A ADAME | TX1334856 (Certified General) 04-30-2019 |

ADAME REALTY ADVISORS, INC. P.O. BOX 8324 CORPUS CHRISTI, TX 784680000 |

| CATHY L HARPER | TX1335187 (Certified Residential) 08-31-2019 |

C L HARPER & ASSOC. APPRAISERS 13617 PORT ROYAL COURT CORPUS CHRISTI, TX 784180000 |

| TRAVIS J BENNETT | TX1335814 (Certified Residential) 02-29-2020 |

CASTLE APPRAISAL SERVICE, INC 5430 HOLLY RD STE 8 CORPUS CHRISTI, TX 784110000 |

| ELIZABETH B CANFIELD | TX1336293 (Certified Residential) 08-31-2018 |

CANFIELD APPRAISAL SERVICES 5842 CRESTHAVEN DRIVE CORPUS CHRISTI, TX 784150000 |

| JASON P GRUBERT | TX1337394 (Certified Residential) 02-29-2020 |

COASTAL BEND VALUATION, LLC 2732 S.P.I.D. #370 CORPUS CHRISTI, TX 784150000 |

| CHRISTINE M KIDD | TX1360303 (Certified Residential) 04-30-2018 |

ACCURATE APPRAISAL ASSOC. P. O. BOX 1125 CORPUS CHRISTI, TX 784030000 |

| ANALISSA R MONTALVO | TX1360605 (Certified Residential) 10-31-2018 |

CALLAWAY & COMPANY 4502 S. STAPLES STREET CORPUS CHRISTI, TX 784110000 |

| CRAIG R HEWERDINE | TX1360606 (Certified Residential) 10-31-2018 |

15117 GUADALUPE RIVER DR CORPUS CHRISTI, TX 784100000 |

Expiration Date

(Certified General)

03-31-2019

P.O. BOX 81492

CORPUS CHRISTI, TX 784680000

(Certified General)

05-31-2019

4502 SOUTH STAPLES ST

CORPUS CHRISTI, TX 784110000

(Certified Residential)

06-30-2019

6000 S. STAPLES ST, #303

CORPUS CHRISTI, TX 784130000

(Certified Residential)

06-30-2019

P O BOX 81492

CORPUS CHRISTI, TX 784680000

(Certified Residential)

06-30-2019

CORPUS CHRISTI, TX 784180000

(Certified General)

06-30-2019

3526 S. ALAMEDA

CORPUS CHRISTIE, TX 784110000

(Certified Residential)

06-30-2019

P.O. BOX 260098

CORPUS CHRISTI, TX 784260000

(Certified Residential)

06-30-2019

1333 ORMOND DR,

CORPUS CHRISTI, TX 784150000

(Certified General)

02-28-2018

In 30-Day Grace Period

Valid until 03-30-2018

400 MANN STREET SUITE # 509

CORPUS CHRISTI, TX 784010000

(Certified General)

02-29-2020

3230 REID DRIVE SUITE A

CORPUS CHRISTI, TX 784040000

(Certified Residential)

02-28-2018

In 30-Day Grace Period

Valid until 03-30-2018

PO BOX 60134

CORPUS CHRISTI, TX 784660000

(Certified Residential)

02-28-2018

In 30-Day Grace Period

Valid until 03-30-2018

P.O. BOX 81492

CORPUS CHRISTI, TX 784680000

(Certified Residential)

11-30-2018

CORPUS CHRISTI, TX 784110000

(Certified Residential)

11-30-2018

PO BOX 270566

CORPUS CHRISTI, TX 784270000

(Certified General)

05-31-2019

P.O. BOX 81492

CORPUS CHRISTI, TX 784680000

(Certified Residential)

12-31-2018

4801 BALDWIN #103

CORPUS CHRISTI, TX 784080000

(Certified Residential)

02-28-2019

3230 REID DRIVE

CORPUS CHRISTI, TX 784040000

(Certified Residential)

07-31-2019

5134 GRAFORD PLACE

CORPUS CHRISTI, TX 784130000

(Certified Residential)

03-31-2018

502 SANTA MONICA PLACE

CORPUS CHRISTI, TX 784110000

(Certified General)

05-31-2018

502 SANTA MONICA PL

CORPUS CHRISTI, TX 784110000

(Certified General)

07-31-2019

CORPUS CHRISTI, TX 784110000

(Certified Residential)

03-31-2019

P. O. BOX 8271

CORPUS CHRISTI, TX 784680000

(Certified Residential)

06-30-2018

4502 SOUTH STAPLES ST.

CORPUS CHRISTI, TX 784110000

(Certified Residential)

05-31-2019

3526 SOUTH ALAMEDA

CORPUS CHRISTI, TX 784110000

(Certified Residential)

06-30-2019

P.O. BOX 271387

CORPUS CHRISTI, TX 784270000

(Certified Residential)

09-30-2018

320 POENISCH DRIVE

CORPUS CHRISTI, TX 784120000

(Certified Residential)

06-30-2019

13934 MINGO CAY CT APT C

CORPUS CHRISTI, TX 784180000

(Certified Residential)

08-31-2019

P.O. BOX 81492

CORPUS CHRISTI, TX 784680000

(Certified Residential)

12-31-2019

3141 QUAIL SPRINGS #7

CORPUS CHRISTI, TX 784140000

(Certified Residential)

04-30-2018

P.O.BOX 2832

CORPUS CHRISTI, TX 784030000

(Certified General)

04-30-2019

P.O. BOX 8324

CORPUS CHRISTI, TX 784680000

(Certified Residential)

08-31-2019

13617 PORT ROYAL COURT

CORPUS CHRISTI, TX 784180000

(Certified Residential)

02-29-2020

5430 HOLLY RD STE 8

CORPUS CHRISTI, TX 784110000

(Certified Residential)

08-31-2018

5842 CRESTHAVEN DRIVE

CORPUS CHRISTI, TX 784150000

(Certified Residential)

02-29-2020

2732 S.P.I.D. #370

CORPUS CHRISTI, TX 784150000

(Certified Residential)

04-30-2018

P. O. BOX 1125

CORPUS CHRISTI, TX 784030000

(Certified Residential)

10-31-2018

4502 S. STAPLES STREET

CORPUS CHRISTI, TX 784110000

(Certified Residential)

10-31-2018

CORPUS CHRISTI, TX 784100000

TEXAS MORTGAGE RESULTS

REFI EXAS HOME 85%LTV- DEBT CONSOLIDATION TX REFINANCE

https://www.fhamortgageprograms.com/texas-debt-consolidation-refinance/

TEXAS DEBT CONSOLIDATION refinancing helps many thousands of TEXAS FHA MORTGAGE applicants that need to consolidate debt and lower their monthly obligations. If you have equity in your home, you may be able to leverage it for your financial health. Get rid high-interest credit cares with an FHA TEXAS DEBT …

YES! TEXAS MORTGAGE WITH COLLECTION ACCOUNTS!

https://www.fhamortgageprograms.com/yes-can-get-texas-mortgage-collection-accou…

Can I Still Get a Texas Mortgage? YES!!! Just like you don’t need perfect credit to qualify for a Texasmortgage. And you don’t need to pay off all collection accounts to qualify!!!. Texas Mortgage TexasMortgage LendersLendersdon’t even count medical bill against you!!Credit card bills, collections, and charge-offs – you can ..

Texas Self Employed Get Mortgage Approval with NO Tax Returns!

https://www.fhamortgageprograms.com/texas-self-employed-mortgage-lenders-appro…

Use 12 or 24 months bank statements to get approved for a Texas Mortgage. Same Day Approvals … Being self-employed in Texas comes with several benefits, such as setting your own hours and even working from home! There is one …. https://www.fhamortgageprograms.com/texas-bank-statement-mortgage-

3.5% Down Texas FHA Mortgage Lenders Min 580 Fico!

https://www.fhamortgageprograms.com/texas-fha-mortgage-lenders-3

3.5% Down Texas FHA Mortgage Lenders Min 580 Fico! Min 3.5% down payment minimum 580 fico or 10% down with a 550 fico. Seller paid the closing cost up to 6%. You’ve visited this page many times

TEXAS MORTGAGE WITH COLLECTIONS!! + WE SAY YES!!

https://www.fhamortgageprograms.com/texas-mortgage-with-collections/

Get a Texas mortgage with collections. FHA, VA, SELF EMPLOYED, PAST FORECLOSURE, BK, WE DONT CARE ABOUT Texas MEDICAL Collections. Texas mortgage lenders same day BAD CREDIT TEXASMORTGAGE LENDERS

https://www.fhamortgageprograms.com/chapter-13-bk-mortgage-lenders/

https://www.fhamortgageprograms.com/3-5-down-bad-credit-texas–mortgage–

https://www.fhamortgageprograms.com/texas-mortgage-lenders-2/

Your first step is to apply online or call and visit with a Texas mortgage professional. We’ll take you through all the options, discuss rates and loan types and help customize a loan just for … Texas FHA/VA Mortgage Lenders+Min 580 Fico – FHA mortgage lender … About FHA Mortgage Programs.com – FHA mortgage lender ..

Texas-Bank Statement Only Mortgage Lenders – FHA mortgage lender

https://www.fhamortgageprograms.com/texas-bank-statement-mortgage-lenders

10%DOWN – Self Employed TX Mortgage Lenders No Tax Returns!!

https://www.fhamortgageprograms.com/self-employed-texas-mortgage-lenders-2/

Texas Bank Statement only loans for self-employed Texas mortgage applicants who cannot qualify for a traditional Texas bank loan because of Texas business expenses. Self-employed Texas mortgage Lenders are perfect because while most Texas self-employed borrowers earn a solid income, they show a smaller net …

https://www.fhamortgageprograms.com/texas-fha-mortgage-lenders-bad-credit-no-cre…

Texas FHA-Mortgage-Lenders.com is dedicated to providing current Texas Home Owners and TexasFirst Time Home Buyers so they can Buy A Home with less than 3.5% down and/or FHA Mortgage Refinance up to 96.5% of the home’s value. Explore FHA Loan Programs including Bad Credit Mortgage Lenders or No …